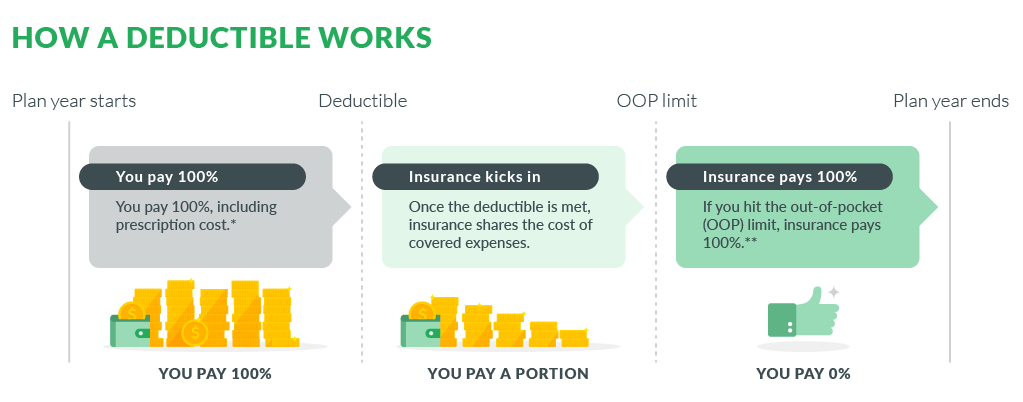

A deductible is a fixed amount of money you must pay before an insurance company will start to pay a portion of covered medical expenses. And your health plan's out-of-pocket (OOP) limit/maximum represents your "worst case" financial exposure in a given year.

* In-network, covered preventive care is typically paid 100% by insurance, regardless of where you stand with your deductible.

** Insurance pays 100% of covered, in-network expenses. You must still continue to pay your monthly premiums to maintain your coverage. The deductible and OOP costs reset on the renewal date of your company’s plan, which may or may not align with the calendar year.

What Counts Towards a Deductible?

Does

Money you pay out-of-pocket for health care services that are a covered benefit of your health plan count towards your annual deductible. Coinsurance also counts.

Doesn't

Copays don't count toward your deductible (although they do count towards your total out-of-pocket limit). Your monthly premium cost doesn't apply towards your deductible, either.

Also, be aware, depending on your health plan's rules, the amount you pay toward an out-of-network deductible might not count toward your in-network deductible.

What Counts Towards an OOP Limit/Max?

Costs that contribute towards your out-of-pocket (OOP) limit include deductibles, copays, coinsurance for eligible, in-network medical expenses.

The OOP limit does not count premiums, balance billing amounts for out-of-network providers or other out-of-network costs, or expenses that aren't covered by the health plan.

Always check your health plan's Summary of Benefits & Coverage for specific details. The details here provide a general overview. Every health plan differs, and even the "same" health plan can vary by employer.