Choosing between a high- or low-deductible plan is a personal decision that affects both your finances and health care coverage. First, it's important to understand key health plan terms.

Which plan is right for you?

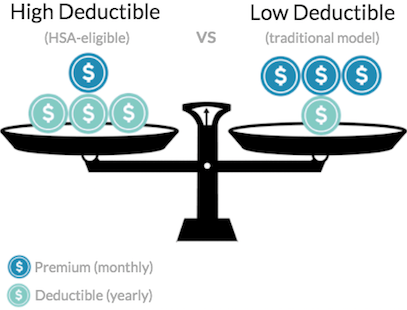

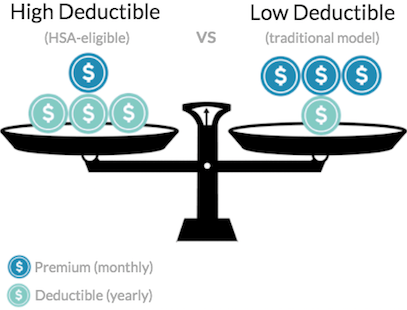

As a general rule, plans with higher deductibles have lower monthly premiums. But there's more to consider than deductibles and premiums. As you compare costs and coverage, you should weigh all these factors:

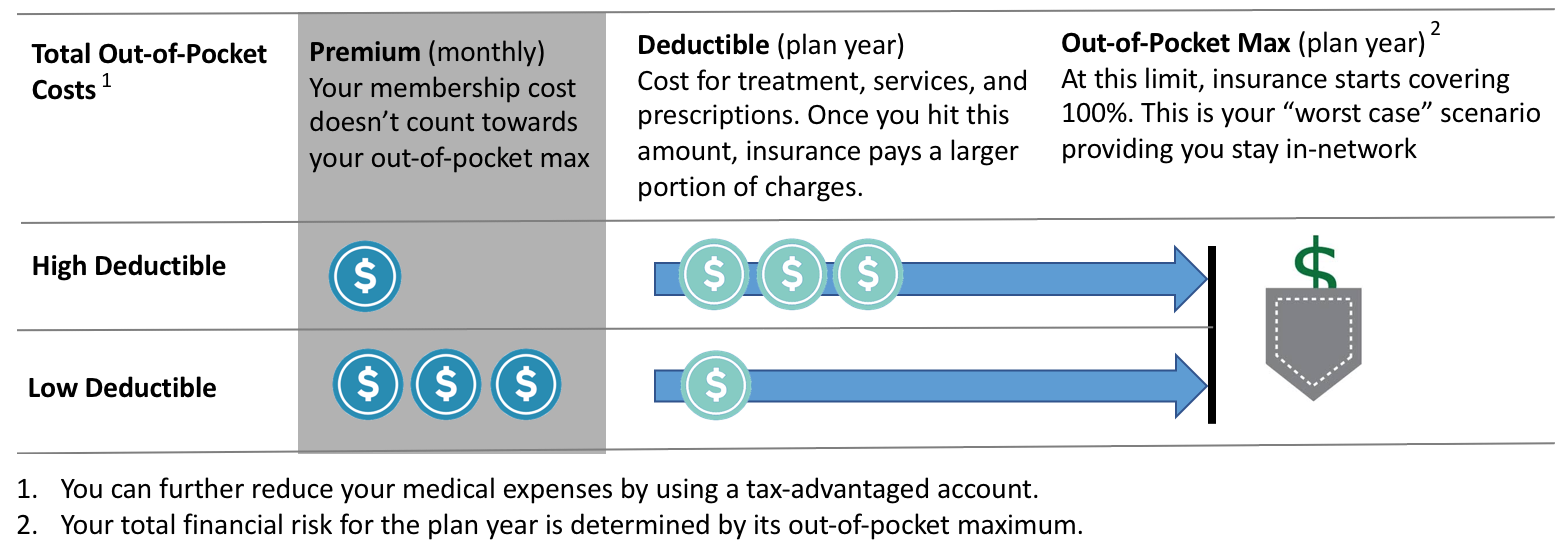

- Premium: amount you pay every month to have insurance, even if you don't use it. Think of premiums as your "membership dues."

- Deductible: out-of-pocket amount you must pay for health care in a plan year before insurance kicks in and starts paying. Once you hit your deductible amount, your insurer pays a larger portion of charges.

- Out-of-Pocket Maximum/Limit: in each plan year, there's a limit to how much you may have to pay providing you stay in-network. Once you've paid this amount, your insurer takes on 100% of covered charges. This number represents your "worst case" financial exposure for a plan year. Just be aware that premiums and out-of-network costs do not count towards your out-of-pocket maximum.

- In-Network Providers: make sure you use doctors and service providers that are in-network. This is a key strategy for keeping costs down and making sure any costs you incur are applied towards your plan's out-of-pocket maximum.

- Prescription Drug Coverage (also called a drug formulary or prescription drug list): make sure you understand how, and whether, a plan pays for the medications you use.

- Tax Advantaged Accounts: a personal healthcare account such as an HSA, FSA, and/or HRA can significantly offset your out-of-pocket medical costs. And, if your employer contributes to a personal healthcare account, this further reduces your expenses.

How much will it cost?

Each plan will have its own cost structure, coverage, and out-of-pocket max. The basic formula to determine your total out-of-pocket costs for a year looks like this:

Total Costs = Monthly Premiums + Deductible (up to the Out-of-Pocket Max)

To get a grasp on what your actual costs might be takes some prediction on your part. Your premiums are a known cost. That's your premium x12. But you need to estimate what you'll spend towards your deductible. What health care needs will you and/or your family have in the year ahead? Consider some of these questions:

- What is your health?

- Are you expecting the birth of a child?

- Any surgeries? Chronic illness? Prescriptions?

With a high-deductible health plan (HDHP), you'll pay less on monthly membership and more when you need to access non-preventative care (preventive care and well-baby checkups are provided at no additional cost).

On the flip side, with a low-deductible health plan you'll pay more on monthly membership but less when you access care.

Did you know...? Pairing an HDHP with a Health Savings Account (HSA) can further reduce your out-of-pocket spending. Doing so changes the formula your total out-of-pocket costs: Total Cost = Monthly Premiums + Deductible - Tax Savings (up to the Out-of-Pocket Max).

Related Reading:

What is a Health Savings Account (HSA)?

The Importance of Staying In-Network